The Cash Flow

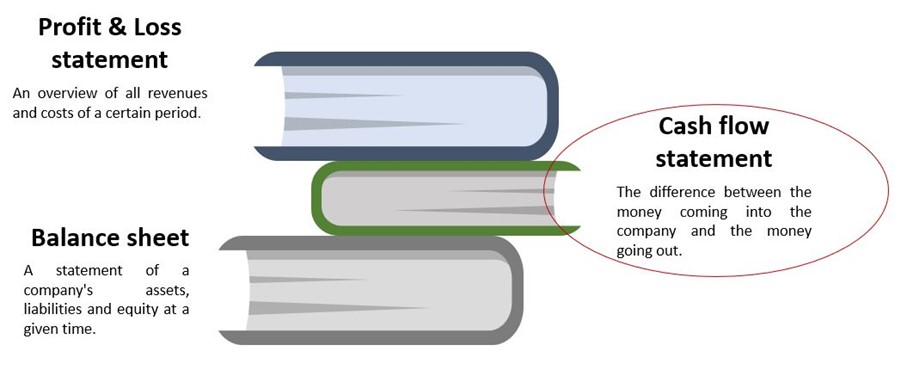

We already explained that there are three basic financial documents. The ‘mother’ document is the balance sheet, which we discussed in lesson1.

Two documents are derived from the balance sheet :

- Profit and Loss statement

- Cash flow statement

The P&L statement we discussed in lesson 2, where we discovered that changes to the internal equity are explained in the Profit and Loss statement.

Now we will continue with the cash flow statement. Changes in the amount of cash on the balance sheet will be explained in the cash flow statement. When writing a financial plan you will be asked to give an insight into your cash flow. Because, even if you have a good business plan, you have to pay the bills! The cash flow statement will show if you have enough ‘cash’ to pay the bills when they show up.

20 minutes

This lesson will take you approximately 20 minutes to work through, that is, if you just follow the explanations.

70 minutes

With additional reading this lesson should take you in total about 70 minutes to complete.

4 hours

With additional reading and a review of the academic articles, journal articles or advanced concepts should take you closer to 4 hours to complete.

In this lesson you find a definition of cash flow, as well as how to calculate it. In order to explain it, we need to introduce a few financial concepts like working capital and non-cash costs. Finally, you will learn why profit isn’t the same as cash, and how you can go bankrupt despite having a profitable business.